sales tax calculator austin texas

The average cumulative sales tax rate between all of them is 708. To make matters worse rates in most major cities reach this limit.

How To Register File Taxes Online In Texas

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825.

. The minimum combined 2022 sales tax rate for Austin Texas is. Cost of Living Indexes. You can find more tax rates and allowances for Austin and Texas in the 2022 Texas Tax Tables.

Sales tax in Austin Texas is currently 825. Fill in price either with or without sales tax. How You Can Affect Your Texas Paycheck.

US Sales Tax Texas Travis Sales Tax calculator Austin. Texas Sales Tax. 2022 Cost of Living Calculator for Taxes.

You can also use Sales Tax calculator at the front page where you can fill in percentages by yourself. Austin County in Texas has a tax rate of 675 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin County totaling 05. Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was.

Sales Tax Permit Application. The Austin Texas sales tax is 825 consisting of 625 Texas state sales tax and 200 Austin local sales taxesThe local sales tax consists of a 100 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc. US Sales Tax calculator Texas Austin.

So your big Texas paycheck may take a hit when your property taxes come due. The current total local sales tax rate in Austin TX is 8250. There is base sales tax by Texas.

If this rate has been updated locally please contact us and we will update. AustinDripping Springs Lib DtHays Co. Did South Dakota v.

Wayfair Inc affect Texas. The December 2020 total local sales tax rate was also 8250. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

BoatMotor Sales Use and New Resident Tax Calculator. The sales tax rate for Austin was updated for the 2020 tax year this is the current sales tax rate we are using in the Austin Texas Sales Tax Comparison Calculator for 202223. Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example.

While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied. Motor Vehicle Taxes and Surcharges. Austin TX 78744 512 389-4800 800 792-1112 TPW Foundation Official Non-Profit Partner.

California are 618 more expensive than Austin Texas. The results are rounded to two decimals. The results are rounded to two decimals.

Choose city or other locality from Austin below for local Sales Tax calculation. Vermont has a 6 general sales tax but an. The Austin Sales Tax is collected by the merchant on all qualifying sales made within Austin.

The County sales tax rate is. You can use our Texas Sales Tax Calculator to look up sales tax rates in Texas by address zip code. Make international tax compliance simpler through automation with Avalara.

Terminate or Reinstate a Business. Use this calculator with the following forms. VesselBoat Application PWD 143 Outboard Motor Application PWD 144.

And all states differ in their enforcement of sales tax. Austin Sales Tax Rates for 2022. Calculator for Sales Tax in the Austin.

Groceries are exempt from the Austin County and Texas state sales. You can see the total tax percentages of localities in the buttons. The most populous zip code in Austin County Texas is.

In part to make up for its lack of a state or local income tax sales and property taxes in Texas tend to be high. The Austin County Texas sales tax is 675 consisting of 625 Texas state sales tax and 050 Austin County local sales taxesThe local sales tax consists of a 050 county sales tax. The base sales tax in Texas is 625.

The Austin sales tax rate is. As far as all cities towns and locations go the place with the highest sales tax rate is San Felipe and the place with the lowest sales tax rate is Bellville. The Texas sales tax rate is currently.

Sales Tax State Local Sales Tax on Food. The Austin County Sales Tax is collected by the merchant on all qualifying sales made within Austin County. Real property tax on median home.

Ad Avalara can help you with global item classification tax calculation filing and more. Calculator for Sales Tax in the Austin. Sales Tax Calculator Sales Tax Table.

Before-tax price sale tax rate and final or after-tax price. This is the total of state county and city sales tax rates. AustinE Travis Gateway Lib Dist.

625 percent of sales price minus any trade-in allowance. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. In Texas prescription medicine and food seeds are exempt from taxation.

Fill in price either with or without sales tax. Counties cities and districts impose their own local taxes. Counties cities and districts impose their own local taxes.

How much is sales tax in Austin in Texas. Be aware though that payroll taxes arent the only relevant taxes in a household budget. Texas has a 625 statewide sales tax rate but also has 998 local tax jurisdictions including.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. Austin Texas and San Jose California. Austin in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Austin totaling 2.

Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services. US Sales Tax Texas Williamson Sales Tax calculator Austin. There is base sales tax by Texas.

The most populous location in Austin County Texas is Sealy.

H R Block Tax Calculator Services

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Texas Sales Tax Rates By City County 2022

Sales Tax Chart 8 25 Google Search Sales Tax Chart Otosection

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Texas Car Sales Tax Everything You Need To Know

How To Calculate Texas Sales Tax

How To Register File Taxes Online In Texas

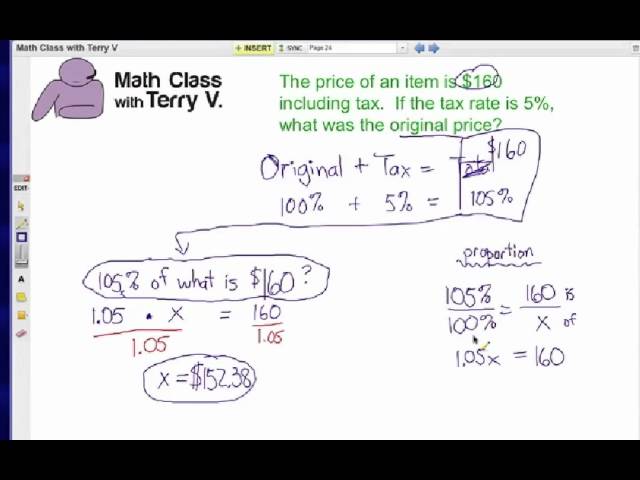

How To Find Original Price Tax 1 Youtube

Property Tax Calculator Casaplorer

How To Register File Taxes Online In Texas

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Texas Income Tax Calculator Smartasset

Texas Income Tax Calculator Smartasset

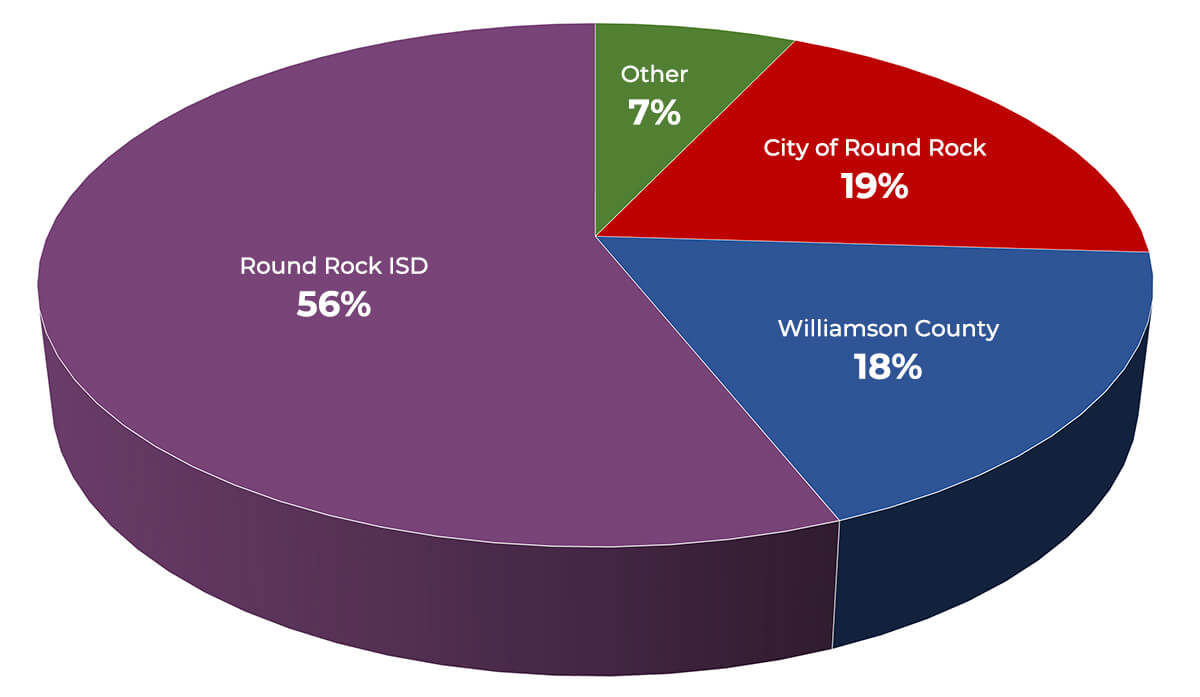

Blog How We Pay For Basic City Services May Surprise You City Of Round Rock

Texas Income Tax Calculator Smartasset

What Is Georgia S Sales Tax Discover The Georgia Sales Tax Rate For 159 Counties